south carolina inheritance tax rate

The top inheritance tax rate is 15 percent no exemption threshold Rhode Island. Your average tax rate is 1198 and your.

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

Additionally after deductions and credits estate tax is only imposed on the value of an estate that exceeds the exemption.

. South Carolina Income Tax Calculator 2021. On the one hand it makes the states estate planning and inheritance procedure easier. Like estate taxes and inheritance taxes South Carolina also does not have a gift tax.

The federal estate tax exemption is 117 million in. Any excess over the exemption amount is applied at a rate of 40. Counties may impose an.

South Carolina has no estate tax for decedents dying on or after January 1 2005. Technically North Carolina residents dont pay the inheritance tax or estate tax when they inherit an estate within the state. Still individuals who are gifted more than 15000 in one calendar year are subject to the.

Even though there is no South Carolina estate tax the federal estate tax might still apply to you. What is Sales Tax. Detailed South Carolina state income tax rates and brackets are.

No estate or inheritance tax. In South Carolina the median property tax rate is 566 per 100000 of assessed home value. In January 2013 Congress set the estate tax exemption at 5000000.

The top estate tax rate is 16 percent exemption threshold. South Carolina Estate and Inheritance Taxes. The South Carolina income tax has six tax brackets with a maximum marginal income tax of 700 as of 2022.

The local South Carolina tax laws and exclusions from the federal tax rates allow a South Carolina resident to protect up to 12 million worth of estate from the federal fiscal burden. Federal Estate Tax. The South Carolina income tax has six tax brackets with a maximum marginal income tax of 700 as of 2022.

South Carolina does not have inheritance and estate taxes. As used in this. Sales tax is imposed on the sale of goods and certain services in South Carolina.

If you make 70000 a year living in the region of South Carolina USA you will be taxed 12409. South Carolinas corporate income tax rate is a flat rate of 50 and there are a number of corporate income tax incentives making South Carolina a favorable place to do business in. In the United States the estate tax is a major source of revenue for state and local governments.

Like estate taxes and inheritance taxes South Carolina also does not have a gift tax. The statewide sales and use tax rate is six percent 6. It is one of the 38 states that does not have either inheritance.

On the one hand it makes the states estate planning and inheritance procedure easier. This chapter may be cited as the South Carolina Estate Tax Act. South Carolina and the federal government update Withholding Tax Tables every year.

State Inheritance Taxes. If a South Carolina resident is earning wages in. 2021 SC Withholding Tax Formula 2021 SC W-4.

However there are 2 important exceptions to this. Inheritance taxes which are calculated based on who inherits the estate as opposed to the overall value of the estate are currently collected in the.

Senate Approves Possible 500 Bonus For Sc State Employees Skilled Nursing Facility Nursing Facility Ferry Building San Francisco

South Carolina Estate Tax Everything You Need To Know Smartasset

South Carolina Estate Tax Everything You Need To Know Smartasset

A Guide To South Carolina Inheritance Laws

South Carolina Estate Tax Everything You Need To Know Smartasset

What Is Private Mortgage Insurance Pmi Private Mortgage Insurance Mortgage Payment Mortgage Companies

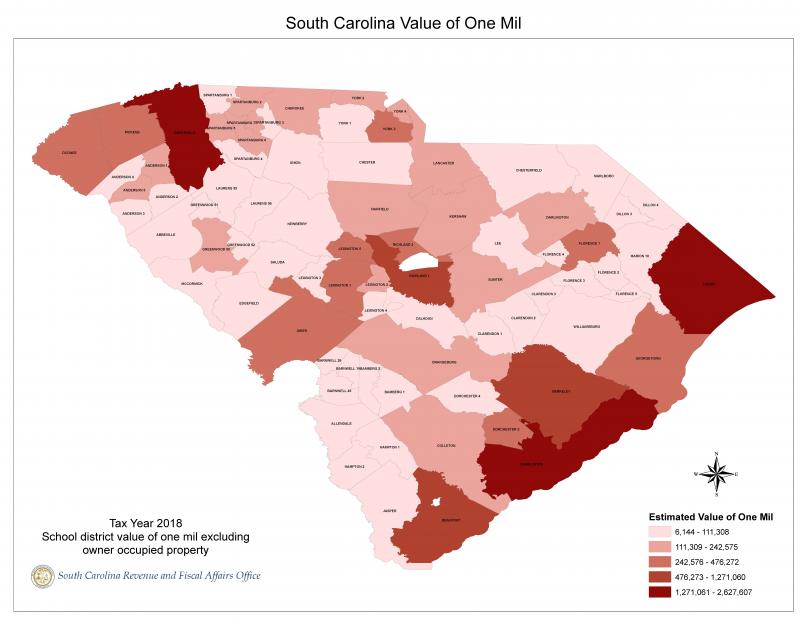

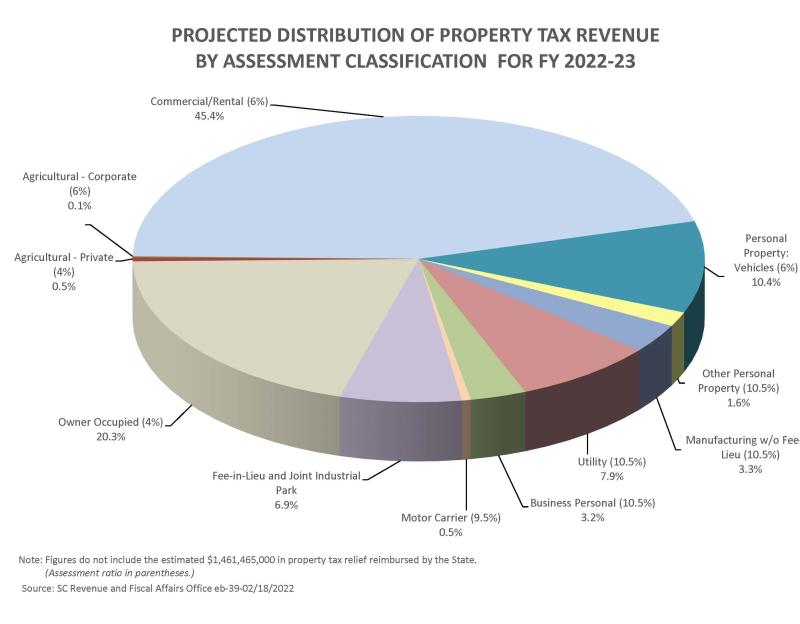

Property Tax Reports South Carolina Revenue And Fiscal Affairs Office

Real Estate Property Tax Data Charleston County Economic Development

Boo St Clair County Real Estate Taxes 892 Historic Homes Historic Homes For Sale Old House Dreams

Ultimate Guide To Understanding South Carolina Property Taxes

South Carolina Sales Tax Small Business Guide Truic

States Where Residents Are Most Satisfied Estate Tax Inheritance Tax Inheritance

South Carolina Tax Rates Rankings Sc State Taxes Tax Foundation

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

Real Estate Tax Deductions Infographic The Agencylogic Blog Tax Day Estate Tax Real Estate Infographic

State Gasoline Tax Rates By The Tax Foundation Infographic Map Safest Places To Travel Fun Facts

Property Tax Reports South Carolina Revenue And Fiscal Affairs Office

Lancaster County South Carolina They Had Named Their County For The House Of Lancaster Which South Carolina Vacation North Carolina Vacations South Carolina

Are There Any States With No Property Tax In 2020 Free Investor Guide Property Tax Small Towns Usa West Virginia